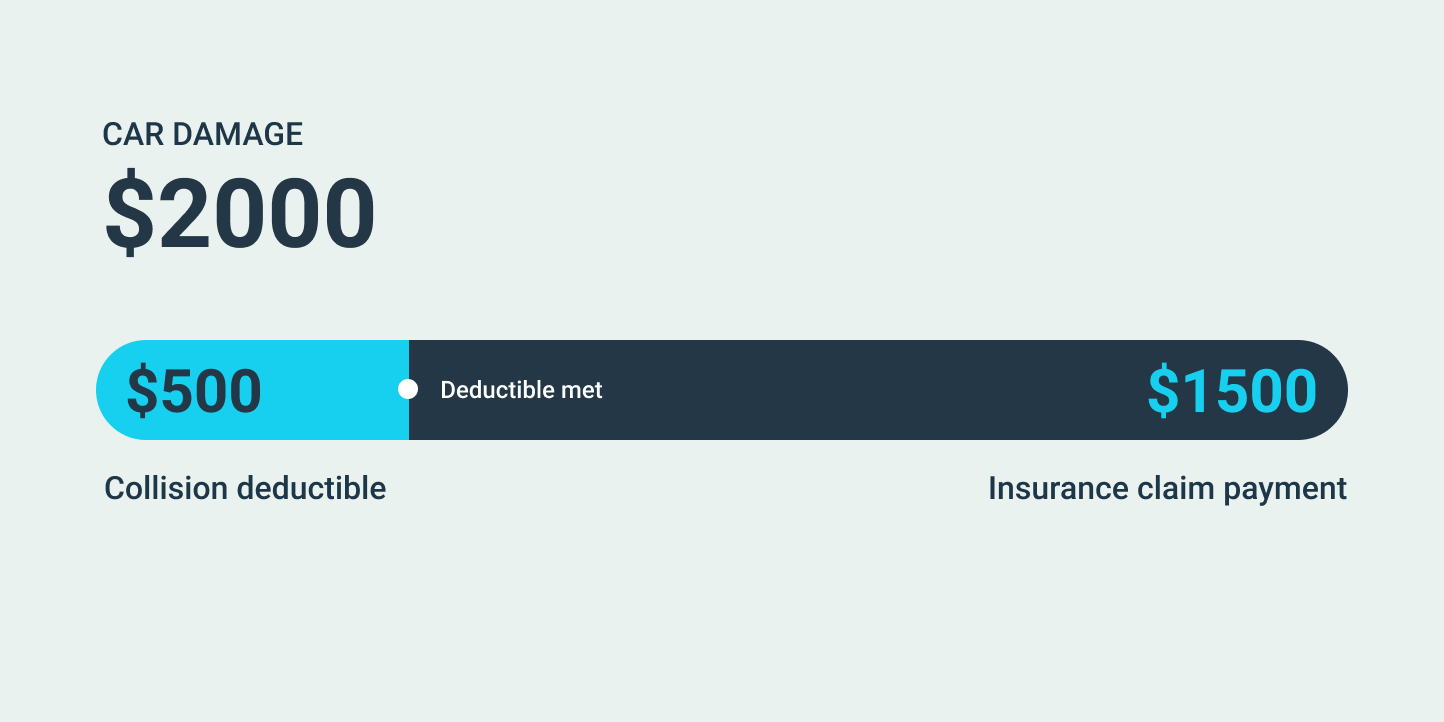

| A insurance deductible is the amount of money you, as the policyholder, are required to pay out of your own pocket before your insurance policy begins to cover the costs of a claim. Deductibles are a common feature in various types of insurance, including health insurance, auto insurance, homeowners insurance, and more. The purpose of a deductible is to share the financial risk between the insurance company and the policyholder and to help control the cost of insurance premiums. Here's how a deductible works: Policy Coverage Begins: When you file a claim with your insurance company, your coverage will begin to take effect. However, the insurance company will not start paying for the covered expenses immediately. Out-of-Pocket Payment: You are responsible for paying the deductible amount out of your own funds first. For example, if you have a $1,000 deductible and file a claim for $5,000 in damages, you will need to pay the initial $1,000, and the insurance company would cover the remaining $4,000. Insurance Company Coverage: After you have paid the deductible, your insurance company will begin covering eligible expenses as outlined in your policy. The insurance company typically pays the portion that exceeds the deductible amount, up to the policy limits. Deductibles have several purposes. Risk Sharing: Deductibles encourage policyholders to share some of the financial responsibility for their claims. This helps prevent overuse of insurance and keeps premiums more affordable. Cost Control: By requiring policyholders to pay a deductible, insurance companies can better control their payouts and provide more predictable pricing for insurance premiums. Protection Against Small Claims: Deductibles are typically higher for policies that cover larger, more catastrophic events (e.g., health insurance for major medical expenses) and lower for smaller, more frequent claims (e.g., auto insurance for minor fender benders). Incentive for Responsible Behavior: Deductibles can encourage policyholders to take steps to avoid unnecessary claims or minimize damage, such as practicing safe driving or home maintenance. Deductibles can vary depending on the type of insurance and the specific policy. In health insurance, for example, you may have an annual deductible, while in auto insurance, it may apply to each covered incident. When choosing an insurance policy, it's essential to consider the deductible amount, along with the premium cost, to find the right balance between out-of-pocket expenses and the level of financial protection you need. |

what is a deductible in insurance

- May 05, 2024

Personal Insurance

Colorado

Insurance

Windsor

Fort Collins